Share:

Bitcoin is currently getting close to the 120,000 mark, which many traders consider a new catalyst to the broader crypto market. Though it has been an outstanding performance by BTC in 2025, the real test is how a clean break above 120K will affect altcoins, presale tokens, and investor sentiment, in general. The ripple effect of a Bitcoin breakout is crucial to know in order to position early and to manage risk when diversifying across asset classes.

Bitcoin First, Then Alts Follow

Whenever Bitcoin enters a strong upward phase, it tends to dominate market liquidity as capital flows into what is widely viewed as the most stable and institutionally backed crypto asset. This behavior has played out consistently in past bull cycles. If Bitcoin breaks above the $120K mark, it will likely continue drawing attention in the short term. However, this does not mean altcoins will be left behind. Historically, once Bitcoin stabilizes after a major breakout, capital begins rotating into altcoins, especially those with strong narratives or innovative use cases.

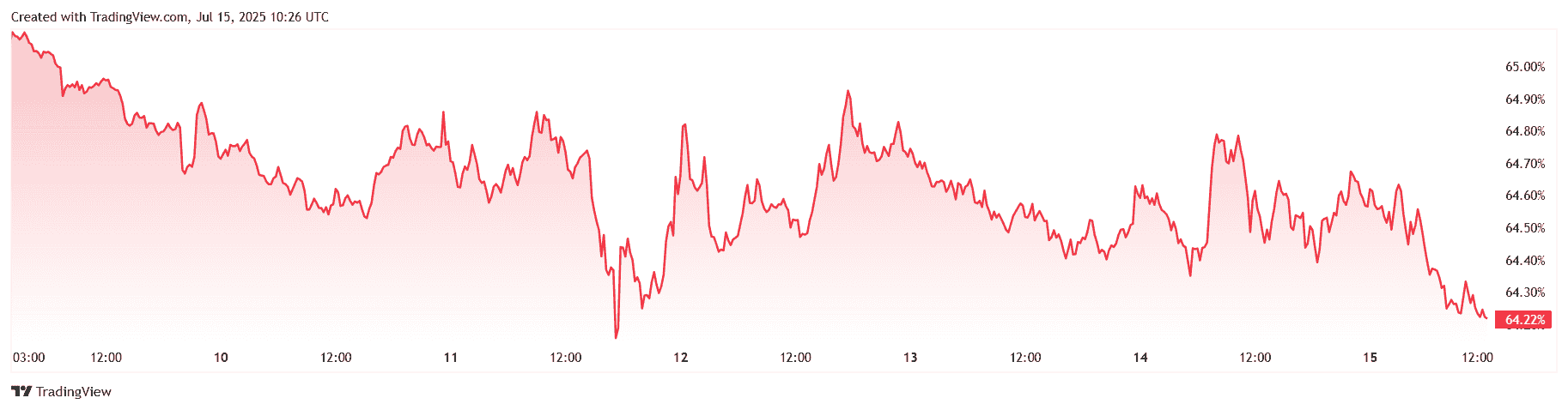

New statistics confirm this possibility. The dominance of Bitcoin has been falling gradually since it was at slightly more than 65 percent to 64.22 percent by July 15, 2025, which shows that the appetite of investors is beginning to change. Despite the temporary spikes, the overall trend indicates declining BTC dominance compared to other crypto market assets. This chart movement has been said to be a sign of an impending altcoin season, with mid and low-cap projects starting to perform better. If the trend continues, it may confirm that the market is preparing for broader distribution of capital beyond Bitcoin.

Altcoin Season Signals

Once Bitcoin cools off or trades sideways after a breakout, capital often rotates into mid- and low-cap coins. This marks the beginning of what traders call "altcoin season." During this phase, projects with strong fundamentals, real-world use cases, or early-stage momentum often outperform.

We covered several such strategies in our article on top altcoin investment strategies in a bull market, where identifying sector trends and timing rotations can be the difference between average and outsized returns. A Bitcoin move past $120K is likely to accelerate these dynamics, opening the door for undervalued altcoins to rise.

Ethereum and the Layer-1 Effect

Ethereum, often seen as the primary beneficiary of altcoin rotation, could also gain significantly. With ETH showing strength and ongoing developments in scaling and staking, many believe it is well-positioned to follow BTC’s lead.

In fact, we explored Ethereum’s 2025 outlook in depth in our article Is Ethereum Set to Soar in 2025?, which breaks down why the ecosystem surrounding Ethereum including DeFi, NFTs, and Layer-2 chains may act as a growth multiplier in this cycle.

Risk Appetite Expands as Bitcoin Strengthens

When Bitcoin pushes through a major level like 120K, it often improves overall market confidence. Investors who were previously cautious begin to feel more comfortable exploring opportunities beyond the top assets. This shift does not directly cause a presale boom, but it does create conditions where early-stage projects receive more attention.

Historically, the pattern is simple. First, money flows into Bitcoin. Once the price stabilizes, capital begins moving into strong altcoins. Only after this phase do investors look at smaller, early-stage projects that offer higher risk and higher reward potential. Rising confidence encourages people to consider opportunities they may have ignored during uncertain periods.

For presale and emerging utility projects, this environment can be supportive, but it also attracts speculation. The challenge for investors is identifying which early-stage projects have genuine value and which ones are simply riding the momentum.

How to Position Ahead of the Breakout

Waiting for Bitcoin to hit $120K before making a move may be too late. Investors who want to take advantage of the coming shifts should already be planning their allocations. A diversified approach that includes Bitcoin, quality altcoins, and high-conviction presales offers exposure across all market phases.

It is also important to track sentiment indicators, dominance charts, and upcoming macro catalysts. Bitcoin ETF flows, interest rate changes, and global regulatory signals all feed into the market’s confidence level. But if price action continues to trend upward with volume, the $120K breakout could be the point where 2025’s bull market fully ignites.

Final Thoughts

Bitcoin reaching above 120,000 would not only be a headline. It would be a structural transition that would provide access to broader adoption, restored investor confidence, and gargantuan market rotation. Altcoins, Ethereum, and presale tokens are all set to be benefited in case history repeats itself.

Yet among people planning today, the best chances might not be in doing what the crowd is doing, but being in front of it.